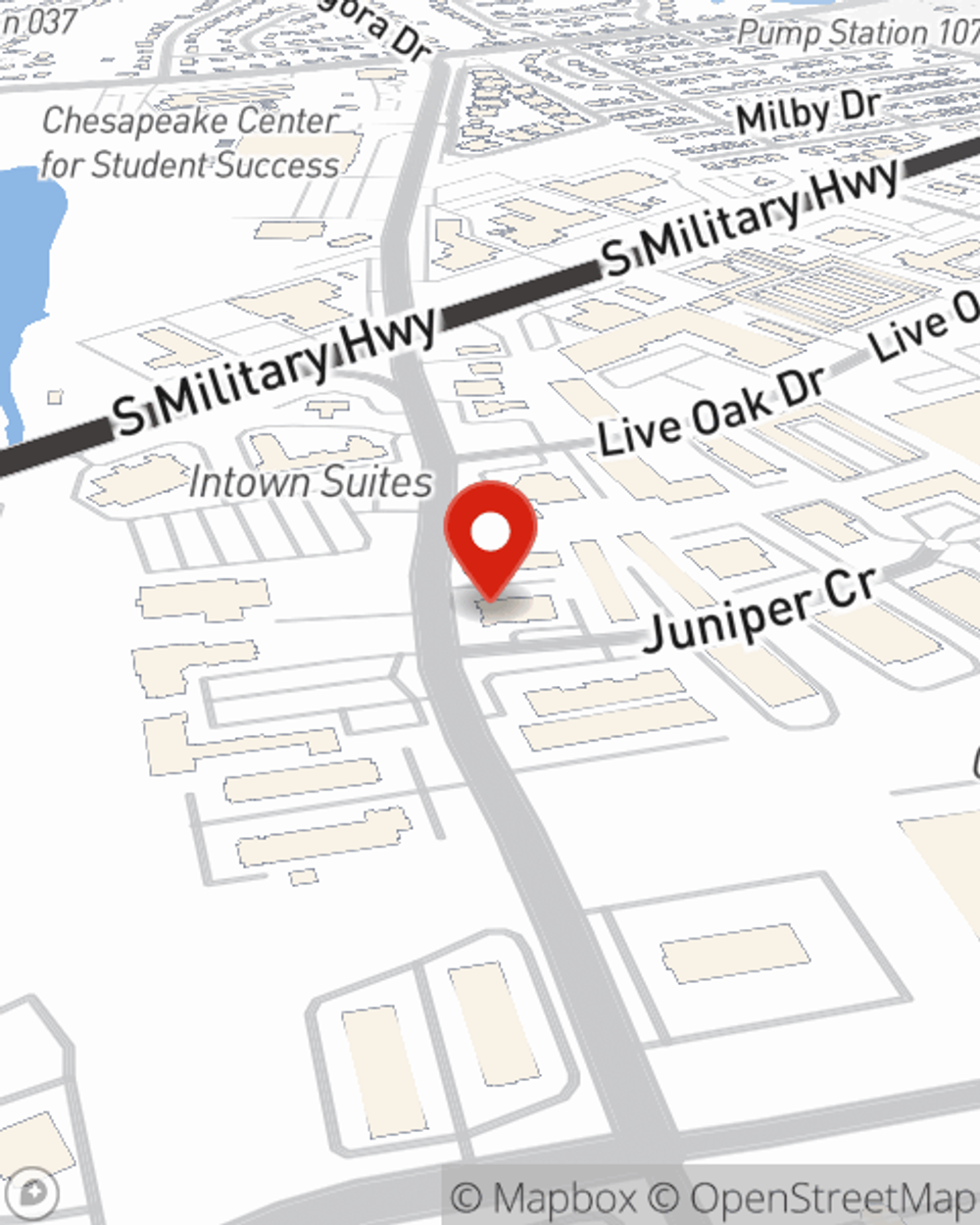

Business Insurance in and around Chesapeake

One of the top small business insurance companies in Chesapeake, and beyond.

Cover all the bases for your small business

- Suffolk

- Virginia Beach

- Windsor

- Hampton

- Norfolk

- Smithfield

- Newport News

- Isle of Wight

- Franklin

This Coverage Is Worth It.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes problems like a customer stumbling and falling can happen on your business's property.

One of the top small business insurance companies in Chesapeake, and beyond.

Cover all the bases for your small business

Protect Your Business With State Farm

With options like worker's compensation for your employees, errors and omissions liability, a surety or fidelity bond, and more, having quality insurance can help you and your small business be prepared. State Farm agent Nina Ambrose is here to help you customize your policy and can assist you in submitting a claim when the unexpected does arise.

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Nina Ambrose today to ask about your business insurance options!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Nina Ambrose

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.