Condo Insurance in and around Chesapeake

Looking for outstanding condo unitowners insurance in Chesapeake?

State Farm can help you with condo insurance

- Suffolk

- Virginia Beach

- Windsor

- Hampton

- Norfolk

- Smithfield

- Newport News

- Isle of Wight

- Franklin

Welcome Home, Condo Owners

The life you treasure is rooted in the condo you call home. Your condo is where you wind down, slow down and chill out. It’s where you build a life with the ones you love.

Looking for outstanding condo unitowners insurance in Chesapeake?

State Farm can help you with condo insurance

Protect Your Condo With Insurance From State Farm

You want to protect that important place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as wind, lightning or smoke. Agent Nina Ambrose can help you figure out how much of this awesome coverage you need and create a policy that has what you need.

Ready to learn more? Agent Nina Ambrose is also ready to help you explore what customizable condo insurance options work well for you. Get in touch today!

Have More Questions About Condo Unitowners Insurance?

Call Nina at (757) 413-5025 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

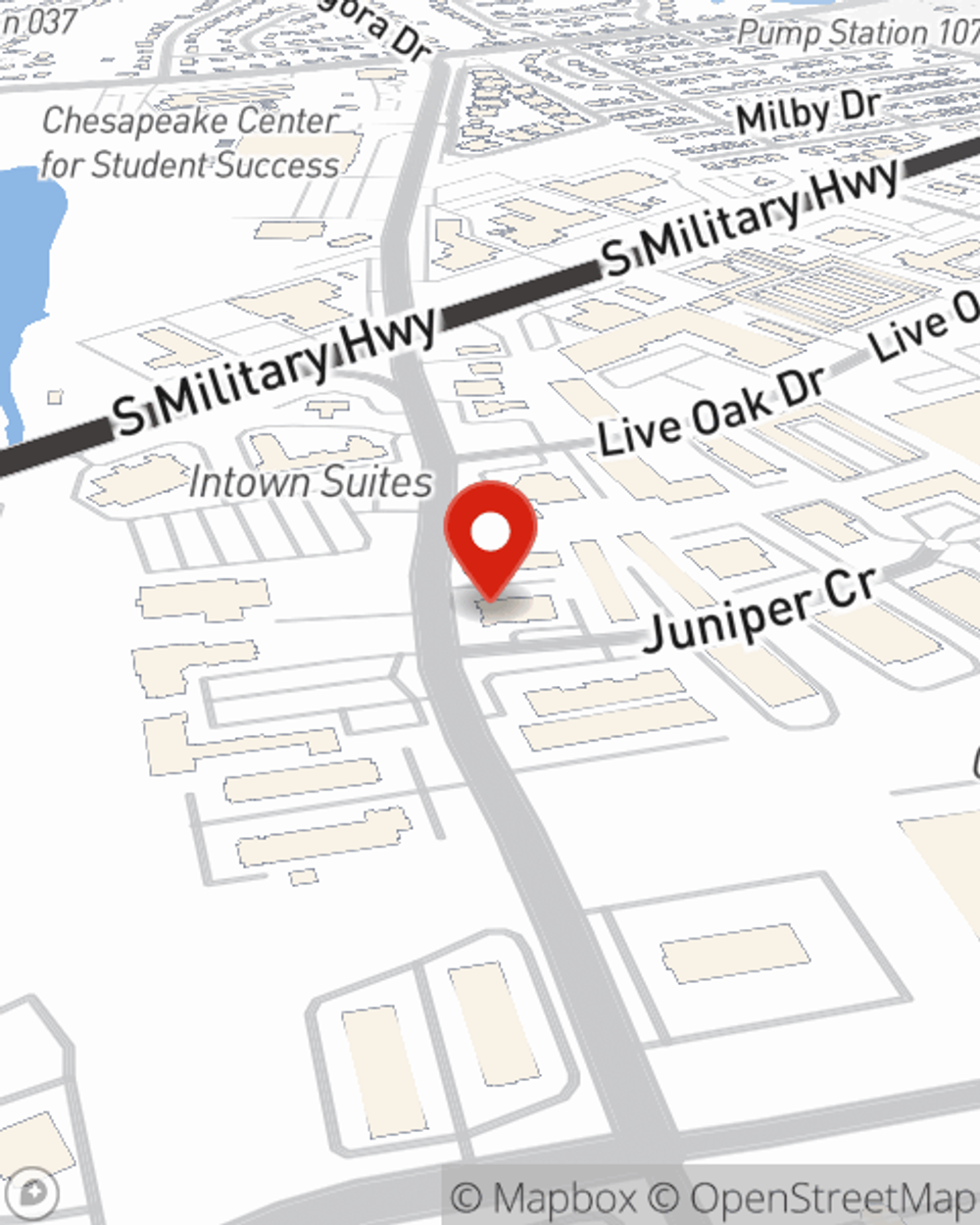

Nina Ambrose

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.